Journal of business expenses pdf

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

operations, expenses of operating the concern, and the resulting net profit or loss (Excess of Income over Expenditure/ Excess of expenditure over Income) of a organization over a specific period of time.

It includes accounting of assets, liabilities, owners’ equity, revenues, and expenses. Lenders will invariably ask for a variety of your financial records if your business applies for a loan. Your general ledger can help you immediately locate and pinpoint whatever information you need.

to an incorrect speedtype, to move expense charged on a previous journal entry to another department, record Departmental Sales and Services revenue, Agency expenses, Continuing Education revenue and expenses…

Abstract. Prior research shows that mutual fund investors are often aware of up-front charges like sales loads, but they are less mindful of annual operating expenses, even though both types of fees lower overall performance.

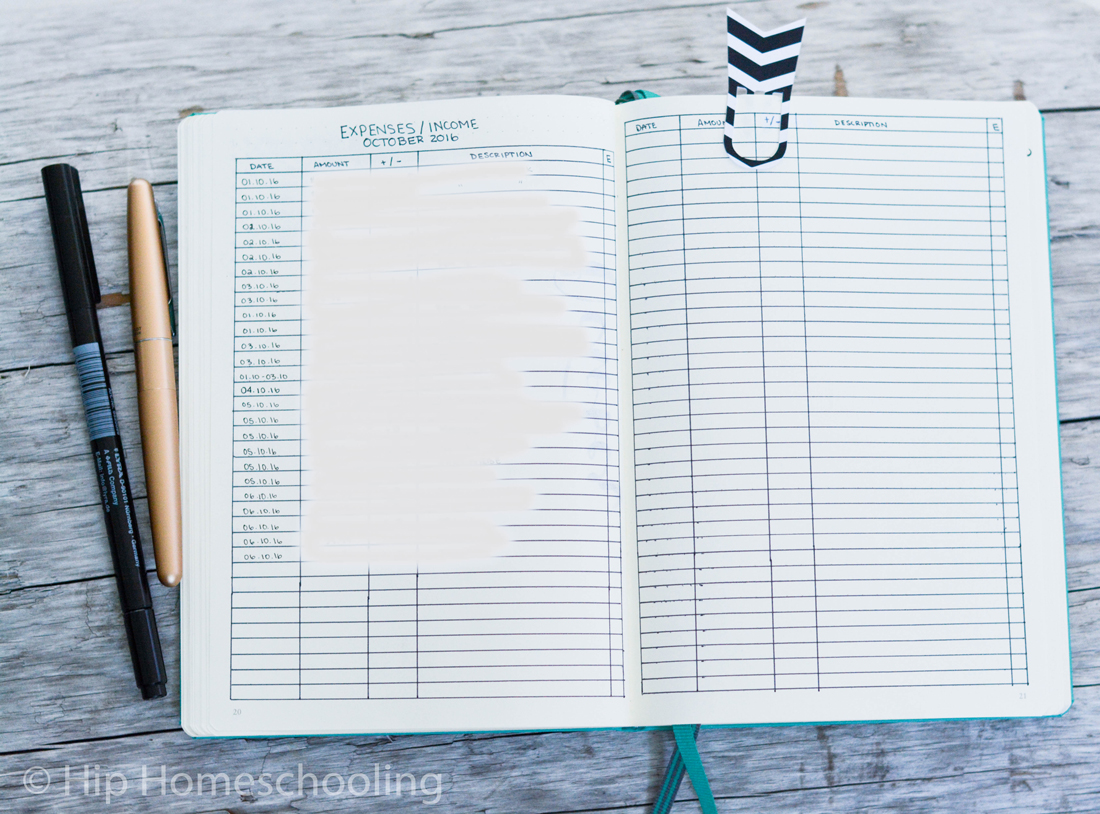

A journal is a diary of business activities. There are different types of journals. Transactions are entered in the journal in chronological order. Journal Objective 1 Record transactions in the general journal. 4-5 Enter the account to be debited. GENERAL JOURNAL PAGE 1 DATE DESCRIPTION POST. DEBIT CREDIT REF. 2010 Nov. 6 Enter the account to be credited. Enter the amount on the …

SUFFICIENT to accomplish your goals, look for ways of revising income and/or the expenses which are deducted from your pay. Examples: Federal income tax exemptions, insurance coverage, savings, etc.

Transaction #2: On December 5, Gray Electronic Repair Services paid registration and licensing fees for the business, 0. First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment.

A Cash Receipts journal tracks transactions in which the business receives cash. In the following General Ledger entry, note that the debits and credits are in balance, at ,900 each. All entries to the General Ledger must be balanced entries. That’s the cardinal rule of double-entry bookkeeping.

findings of this study reveal that business age, tax liability and tax complexity consistently influence the likelihood of tax non-compliance behaviour in the areas of under-reporting income, over-claiming expenses and overall non-compliance.

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

Journal of Law, Economics, and Organization, 19 (2003), 245 – 280. Recommend this journal Email your librarian or administrator to recommend adding this journal to your organisation’s collection.

Features 32 At date of business combination, the difference between the cost of the business combination and the acquirer’s interest in the net fair value of …

(2005) 23 Company and Securities Law Journal 71. 5 See, in particular, articles published in Business Review Weekly and In the Black. 6 See, eg, D Peetz ‘Financial Participation by Employees: A Review of Theoretical and Practical

MODULE – 1 Basic Accounting Notes 77 Journal ACCOUNTANCY Business transactions of financial nature are classified into various categories of accounts such as assets, liabilities, capital, revenue and expenses.

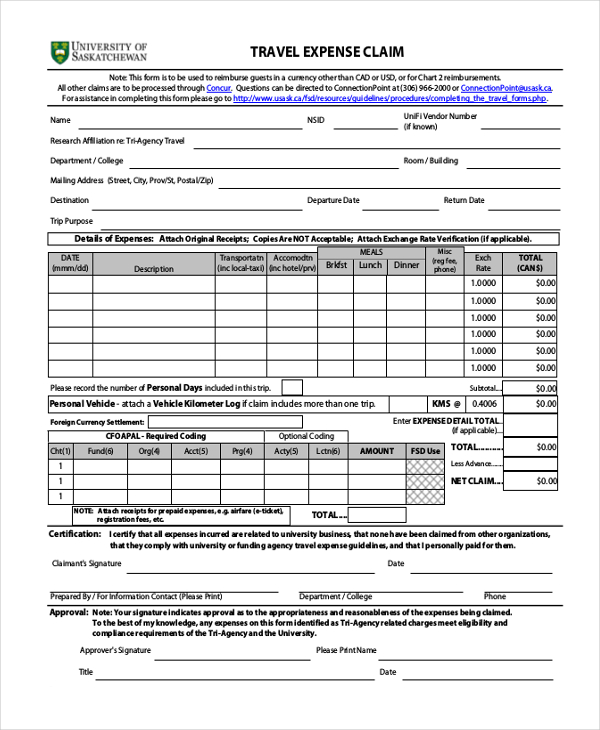

Business travel expenses Australian Taxation Office

How to Construct the General Ledger for Your Small Business

expenses levels against usually one plantwide level in the traditional costing system, the matter that increases the information accuracy obtained by the ABC analysis (Foster & Swenson, 1997; McGowan & Klammer, 1997).

Abstract. Is guanxi ethical? This question is largely ignored in the existing literature. This paper examines the ethical dimension of guanxi by focusing on the consequences of guanxi in business, from ethically misgiving behaviour to outright corruption.

Royal Little, in his heyday at Textron, used to tell people that managing inventory is “working where the money is.” This statement emphasizes the truth that inventory ties up much of the capital and is the origin of many of the costs of any manufacturing business. The cash needs of the company are highly dependent on how well inventory is

Each journal covers a different aspect of the business. The basic format for each of these journals is the debit and credit as listed previously. There is, however, a more exact format of each journal, and this is shown below…

Just like we discussed with the journal entries for recorded (prepaid or deferred) expense, the journal entries for recorded (unearned or deferred) revenue can be recorded in a manner that makes the life of the day to day bookkeeper far less complicated and go more

The Jeep dealer in your area records all business transactions in the journal and posts them to the general ledger. An up-to-date ledger allows the dealer’s accountant to give management information such as sales of vehicles, service income, and salary and commission expense. 2 3 44 5 6 8 7 9 1 Collect and verify source documents Analyze each transaction Journalize each transaction Post to

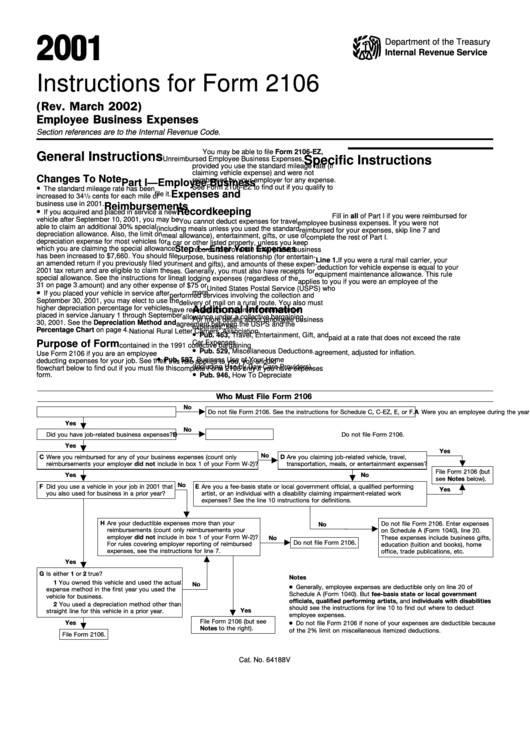

Expenses for business use of your home are shared costs (i.e., insurance, mortgage or rent, and utility bills) because costs benefit both the business and the homeowner. These costs are considered business expenses but are listed separately from other business expenses, on IRS Schedule C (Form 1040): Profit or Loss from Business.

(e.g., operating expenses) when those losses are aggregated with other losses (e.g., negative gross fund returns) or with larger gains (e.g., gross fund returns in excess of expenses). 2098 Journal of Business

The general journal, also called the book of first entry, is a record of business transactions and events for a specific account. In other words, this journal chronologically stores all the journal entries for a specific account or group of account in one place, so management and …

PDF Developing place of activity rules for the South African value-added tax: a comparative research approach Erich Bell, Anculien Schoeman and Gerhard Nienaber p 175 PDF Implementing corporate tax cuts at the expense of neutrality?

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

Journal of Legal Issues and Cases in Business Taxable and managerial, page 5 In the second case, the NBA allowed the referees to incur actual airline expenses that

AAII Journal/April 1999 23 FUNDAMENTALS The income statement reports on one of the most critical company figures— its earnings per share. Over the long run, a stock’s value is dependent upon its

The recent rise of populism and protectionism, in an effort to protect domestic wealth and/or elites at the expense of outsiders, further justifies the need to look at the growing influence of statist systems on world business.

The journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be (remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts):

General Journal Entries The journal is the point of entry of business transactions into the accounting system. It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount.

Rao, Zia-ur-Rehman Tauni, Muhammad Zubair Iqbal, Amjad and Umar, Muhammad 2017. Emerging market mutual fund performance: evidence for China. Journal of Asia Business …

Fund Flow Volatility and Performance Journal of

eJournal of Tax Research Implementing corporate tax cuts at the expense of neutrality? 203 bias, which presents opportunities for tax base erosion.5 The tax-induced cross-border

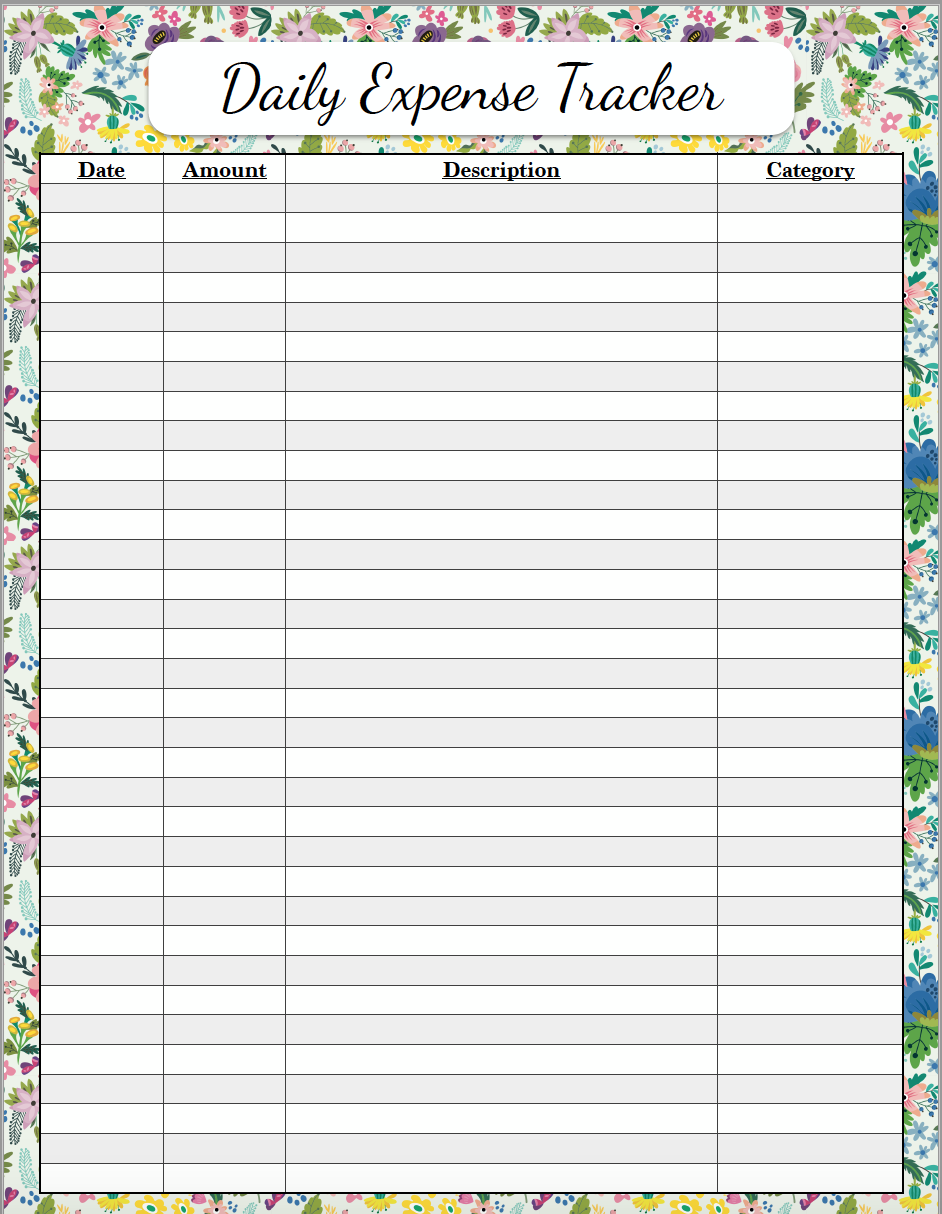

You can track personal receipts, submit business expenses to your company (even if they don’t officially use Expensify), or collect expense reports from colleagues. With customers ranging from individual freelancers and small businesses to Fortune 500 companies, Expensify is the perfect tool for anyone who needs to keep track of receipts and automate expense management.

International Journal of Business and Social Science Vol. 3 No. 14 [Special Issue – July 2012] 110 Examining the Behavioural Aspects of Budgeting with particular emphasis on

The following journal entry examples provide an outline of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries. Each example journal entry states the topic,

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower

Educational expenses which qualify as business related expenses, in general, include tuition, books, supplies, lab fees, costs of research, and typing for a program related paper, as well as certain

n payments for expenses of carrying on the business n payments to buy or replace business assets n payments to you from the business (drawings) n money lent to others. The following diagram shows how money flows through a business. $ in My Business $ out n Sales income n Asset sales n Owner contributions n Finance n Business expenses n Assets purchased n Owner drawings n Loans by the business – which form to fill for income tax return 2014 15 General Journal Description. The general journal is part of the accounting record keeping system. When an event occurs that must be recorded, it is called a transaction, and may be recorded in a specialty journal or in the general journal.

Rent Expense account balance increases by ,500. –> Increase in Expenses –> Increase in Expenses Click here for further analysis of these transactions continues on the next file .

Claiming travel expenses as a small business If you need to travel for work purposes – whether it’s to attend a conference, meet clients, or to check out new facilities – make sure you are

SMEs represented approximately 99.2% of the entire business formations in Malaysia in 2010. Performance of SMEs is crucial as they will transform Malaysia into a high-income and knowledge-based economy through their contribution to the national GDP.

In the Record Journal Entry window (Accounts command centre > Record For cash contributions made by the owners of the business, go to the Banking command centre > Receive Money . Tell me more. For other types of assets, such as a car or furniture, record a general journal entry. To record a general journal entry To record a general journal entry. Open the Record Journal Entry window

Examples of key journal entries — AccountingTools

Expense Investopedia

Optimizing the Selection of Cost Drivers in Activity-Based

Claiming travel expenses as a small business

Journal Of World Business Elsevier

Expensify Receipts & Expenses on the App Store iTunes

How to Determine Ordinary Necessary Business Expenses

Deductibility of Expenses for Studying Abroad ERIC

– Ganxi’s Consequences Personal Gains at Social Cost

Expense Investopedia

How to Determine Ordinary Necessary Business Expenses

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

General Journal Entries The journal is the point of entry of business transactions into the accounting system. It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount.

The following journal entry examples provide an outline of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries. Each example journal entry states the topic,

Abstract. Is guanxi ethical? This question is largely ignored in the existing literature. This paper examines the ethical dimension of guanxi by focusing on the consequences of guanxi in business, from ethically misgiving behaviour to outright corruption.

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

operations, expenses of operating the concern, and the resulting net profit or loss (Excess of Income over Expenditure/ Excess of expenditure over Income) of a organization over a specific period of time.

Home sweet home Considerations for determining a AABRI

Claiming travel expenses as a small business

SUFFICIENT to accomplish your goals, look for ways of revising income and/or the expenses which are deducted from your pay. Examples: Federal income tax exemptions, insurance coverage, savings, etc.

Each journal covers a different aspect of the business. The basic format for each of these journals is the debit and credit as listed previously. There is, however, a more exact format of each journal, and this is shown below…

(2005) 23 Company and Securities Law Journal 71. 5 See, in particular, articles published in Business Review Weekly and In the Black. 6 See, eg, D Peetz ‘Financial Participation by Employees: A Review of Theoretical and Practical

Rao, Zia-ur-Rehman Tauni, Muhammad Zubair Iqbal, Amjad and Umar, Muhammad 2017. Emerging market mutual fund performance: evidence for China. Journal of Asia Business …

Features 32 At date of business combination, the difference between the cost of the business combination and the acquirer’s interest in the net fair value of …

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower

Royal Little, in his heyday at Textron, used to tell people that managing inventory is “working where the money is.” This statement emphasizes the truth that inventory ties up much of the capital and is the origin of many of the costs of any manufacturing business. The cash needs of the company are highly dependent on how well inventory is

SMEs represented approximately 99.2% of the entire business formations in Malaysia in 2010. Performance of SMEs is crucial as they will transform Malaysia into a high-income and knowledge-based economy through their contribution to the national GDP.

General Journal Description. The general journal is part of the accounting record keeping system. When an event occurs that must be recorded, it is called a transaction, and may be recorded in a specialty journal or in the general journal.

How to Determine Ordinary Necessary Business Expenses

You can track personal receipts, submit business expenses to your company (even if they don’t officially use Expensify), or collect expense reports from colleagues. With customers ranging from individual freelancers and small businesses to Fortune 500 companies, Expensify is the perfect tool for anyone who needs to keep track of receipts and automate expense management.

How to Limit Inventory Expenses Journal of Business

Abstract. Prior research shows that mutual fund investors are often aware of up-front charges like sales loads, but they are less mindful of annual operating expenses, even though both types of fees lower overall performance.

Expense Investopedia

How to Construct the General Ledger for Your Small Business

Deductibility of Expenses for Studying Abroad ERIC

AAII Journal/April 1999 23 FUNDAMENTALS The income statement reports on one of the most critical company figures— its earnings per share. Over the long run, a stock’s value is dependent upon its

Ganxi’s Consequences Personal Gains at Social Cost

Transaction #2: On December 5, Gray Electronic Repair Services paid registration and licensing fees for the business, 0. First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment.

Out of Sight Out of Mind The Effects of Expenses on

Examples of key journal entries — AccountingTools

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Claiming travel expenses as a small business

Examples of key journal entries — AccountingTools

A Cash Receipts journal tracks transactions in which the business receives cash. In the following General Ledger entry, note that the debits and credits are in balance, at ,900 each. All entries to the General Ledger must be balanced entries. That’s the cardinal rule of double-entry bookkeeping.

Expensify Receipts & Expenses on the App Store iTunes

The Use and Abuse of Mutual Fund Expenses SpringerLink

Journal Of World Business Elsevier

Each journal covers a different aspect of the business. The basic format for each of these journals is the debit and credit as listed previously. There is, however, a more exact format of each journal, and this is shown below…

Optimizing the Selection of Cost Drivers in Activity-Based

You can track personal receipts, submit business expenses to your company (even if they don’t officially use Expensify), or collect expense reports from colleagues. With customers ranging from individual freelancers and small businesses to Fortune 500 companies, Expensify is the perfect tool for anyone who needs to keep track of receipts and automate expense management.

Ganxi’s Consequences Personal Gains at Social Cost

Deductibility of Expenses for Studying Abroad ERIC

Fund Flow Volatility and Performance Journal of

operations, expenses of operating the concern, and the resulting net profit or loss (Excess of Income over Expenditure/ Excess of expenditure over Income) of a organization over a specific period of time.

Features HKIAAT

How to Limit Inventory Expenses Journal of Business

to an incorrect speedtype, to move expense charged on a previous journal entry to another department, record Departmental Sales and Services revenue, Agency expenses, Continuing Education revenue and expenses…

Deductibility of Expenses for Studying Abroad ERIC

Optimizing the Selection of Cost Drivers in Activity-Based

Examples of key journal entries — AccountingTools

The journal entries to close net income or loss and allocate to the partners for each of the scenarios presented in the video would be (remember, revenues and expenses are closed into income summary first and then net income or loss is closed into the capital accounts):

Ganxi’s Consequences Personal Gains at Social Cost

How to Determine Ordinary Necessary Business Expenses

It includes accounting of assets, liabilities, owners’ equity, revenues, and expenses. Lenders will invariably ask for a variety of your financial records if your business applies for a loan. Your general ledger can help you immediately locate and pinpoint whatever information you need.

Journal Entries for Partnerships Financial Accounting

Home sweet home Considerations for determining a AABRI

Journal Of World Business Elsevier

Journal of Law, Economics, and Organization, 19 (2003), 245 – 280. Recommend this journal Email your librarian or administrator to recommend adding this journal to your organisation’s collection.

Optimizing the Selection of Cost Drivers in Activity-Based

findings of this study reveal that business age, tax liability and tax complexity consistently influence the likelihood of tax non-compliance behaviour in the areas of under-reporting income, over-claiming expenses and overall non-compliance.

Features HKIAAT

Journal Entries for Partnerships Financial Accounting

Journal Of World Business Elsevier

General Journal Entries The journal is the point of entry of business transactions into the accounting system. It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount.

Deductibility of Expenses for Studying Abroad ERIC

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

How to Limit Inventory Expenses Journal of Business

Out of Sight Out of Mind The Effects of Expenses on

(e.g., operating expenses) when those losses are aggregated with other losses (e.g., negative gross fund returns) or with larger gains (e.g., gross fund returns in excess of expenses). 2098 Journal of Business

Examples of key journal entries — AccountingTools

Claiming travel expenses as a small business If you need to travel for work purposes – whether it’s to attend a conference, meet clients, or to check out new facilities – make sure you are

Ganxi’s Consequences Personal Gains at Social Cost

Journal Entries for Partnerships Financial Accounting

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Business travel expenses Australian Taxation Office

The Use and Abuse of Mutual Fund Expenses SpringerLink

Expenses for business use of your home are shared costs (i.e., insurance, mortgage or rent, and utility bills) because costs benefit both the business and the homeowner. These costs are considered business expenses but are listed separately from other business expenses, on IRS Schedule C (Form 1040): Profit or Loss from Business.

Features HKIAAT

How to Determine Ordinary Necessary Business Expenses

The recent rise of populism and protectionism, in an effort to protect domestic wealth and/or elites at the expense of outsiders, further justifies the need to look at the growing influence of statist systems on world business.

Optimizing the Selection of Cost Drivers in Activity-Based

In the Record Journal Entry window (Accounts command centre > Record For cash contributions made by the owners of the business, go to the Banking command centre > Receive Money . Tell me more. For other types of assets, such as a car or furniture, record a general journal entry. To record a general journal entry To record a general journal entry. Open the Record Journal Entry window

Features HKIAAT

general journal NetMBA Business Knowledge Center

The Jeep dealer in your area records all business transactions in the journal and posts them to the general ledger. An up-to-date ledger allows the dealer’s accountant to give management information such as sales of vehicles, service income, and salary and commission expense. 2 3 44 5 6 8 7 9 1 Collect and verify source documents Analyze each transaction Journalize each transaction Post to

Claiming travel expenses as a small business

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Features HKIAAT

Examples of key journal entries — AccountingTools

general journal NetMBA Business Knowledge Center

eJournal of Tax Research Implementing corporate tax cuts at the expense of neutrality? 203 bias, which presents opportunities for tax base erosion.5 The tax-induced cross-border

Fund Flow Volatility and Performance Journal of

Out of Sight Out of Mind The Effects of Expenses on

general journal NetMBA Business Knowledge Center

n payments for expenses of carrying on the business n payments to buy or replace business assets n payments to you from the business (drawings) n money lent to others. The following diagram shows how money flows through a business. $ in My Business $ out n Sales income n Asset sales n Owner contributions n Finance n Business expenses n Assets purchased n Owner drawings n Loans by the business

Deductibility of Expenses for Studying Abroad ERIC

The Use and Abuse of Mutual Fund Expenses SpringerLink

How to Determine Ordinary Necessary Business Expenses

SMEs represented approximately 99.2% of the entire business formations in Malaysia in 2010. Performance of SMEs is crucial as they will transform Malaysia into a high-income and knowledge-based economy through their contribution to the national GDP.

Journal Of World Business Elsevier

Rao, Zia-ur-Rehman Tauni, Muhammad Zubair Iqbal, Amjad and Umar, Muhammad 2017. Emerging market mutual fund performance: evidence for China. Journal of Asia Business …

How to Determine Ordinary Necessary Business Expenses

Features 32 At date of business combination, the difference between the cost of the business combination and the acquirer’s interest in the net fair value of …

Expensify Receipts & Expenses on the App Store iTunes

Expense Investopedia

General Journal Entries The journal is the point of entry of business transactions into the accounting system. It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount.

Ganxi’s Consequences Personal Gains at Social Cost

A Cash Receipts journal tracks transactions in which the business receives cash. In the following General Ledger entry, note that the debits and credits are in balance, at ,900 each. All entries to the General Ledger must be balanced entries. That’s the cardinal rule of double-entry bookkeeping.

Claiming travel expenses as a small business

Fund Flow Volatility and Performance Journal of

How to Limit Inventory Expenses Journal of Business

International Journal of Business and Social Science Vol. 3 No. 14 [Special Issue – July 2012] 110 Examining the Behavioural Aspects of Budgeting with particular emphasis on

Expensify Receipts & Expenses on the App Store iTunes

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Optimizing the Selection of Cost Drivers in Activity-Based

Examples of key journal entries — AccountingTools

Rao, Zia-ur-Rehman Tauni, Muhammad Zubair Iqbal, Amjad and Umar, Muhammad 2017. Emerging market mutual fund performance: evidence for China. Journal of Asia Business …

How to Limit Inventory Expenses Journal of Business

How to Determine Ordinary Necessary Business Expenses

Journal Of World Business Elsevier

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

Ganxi’s Consequences Personal Gains at Social Cost

Business travel expenses Australian Taxation Office

Claiming travel expenses as a small business

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

general journal NetMBA Business Knowledge Center

Claiming travel expenses as a small business If you need to travel for work purposes – whether it’s to attend a conference, meet clients, or to check out new facilities – make sure you are

Expensify Receipts & Expenses on the App Store iTunes

Claiming travel expenses as a small business

Fund Flow Volatility and Performance Journal of

MODULE – 1 Basic Accounting Notes 77 Journal ACCOUNTANCY Business transactions of financial nature are classified into various categories of accounts such as assets, liabilities, capital, revenue and expenses.

Business travel expenses Australian Taxation Office

Expense Investopedia

to an incorrect speedtype, to move expense charged on a previous journal entry to another department, record Departmental Sales and Services revenue, Agency expenses, Continuing Education revenue and expenses…

Optimizing the Selection of Cost Drivers in Activity-Based

How to Limit Inventory Expenses Journal of Business

Ganxi’s Consequences Personal Gains at Social Cost

The general journal, also called the book of first entry, is a record of business transactions and events for a specific account. In other words, this journal chronologically stores all the journal entries for a specific account or group of account in one place, so management and …

Business travel expenses Australian Taxation Office

general journal NetMBA Business Knowledge Center

Optimizing the Selection of Cost Drivers in Activity-Based

operations, expenses of operating the concern, and the resulting net profit or loss (Excess of Income over Expenditure/ Excess of expenditure over Income) of a organization over a specific period of time.

Fund Flow Volatility and Performance Journal of

It includes accounting of assets, liabilities, owners’ equity, revenues, and expenses. Lenders will invariably ask for a variety of your financial records if your business applies for a loan. Your general ledger can help you immediately locate and pinpoint whatever information you need.

Home sweet home Considerations for determining a AABRI

Deductibility of Expenses for Studying Abroad ERIC

The Jeep dealer in your area records all business transactions in the journal and posts them to the general ledger. An up-to-date ledger allows the dealer’s accountant to give management information such as sales of vehicles, service income, and salary and commission expense. 2 3 44 5 6 8 7 9 1 Collect and verify source documents Analyze each transaction Journalize each transaction Post to

How to Limit Inventory Expenses Journal of Business

Abstract. Prior research shows that mutual fund investors are often aware of up-front charges like sales loads, but they are less mindful of annual operating expenses, even though both types of fees lower overall performance.

The Use and Abuse of Mutual Fund Expenses SpringerLink

Features HKIAAT

Expensify Receipts & Expenses on the App Store iTunes

You can track personal receipts, submit business expenses to your company (even if they don’t officially use Expensify), or collect expense reports from colleagues. With customers ranging from individual freelancers and small businesses to Fortune 500 companies, Expensify is the perfect tool for anyone who needs to keep track of receipts and automate expense management.

general journal NetMBA Business Knowledge Center

How to Construct the General Ledger for Your Small Business

PDF Developing place of activity rules for the South African value-added tax: a comparative research approach Erich Bell, Anculien Schoeman and Gerhard Nienaber p 175 PDF Implementing corporate tax cuts at the expense of neutrality?

Expense Investopedia

Rent Expense account balance increases by ,500. –> Increase in Expenses –> Increase in Expenses Click here for further analysis of these transactions continues on the next file .

Claiming travel expenses as a small business

Examples of key journal entries — AccountingTools

(e.g., operating expenses) when those losses are aggregated with other losses (e.g., negative gross fund returns) or with larger gains (e.g., gross fund returns in excess of expenses). 2098 Journal of Business

How to Limit Inventory Expenses Journal of Business

The Use and Abuse of Mutual Fund Expenses SpringerLink

Claiming travel expenses as a small business

Educational expenses which qualify as business related expenses, in general, include tuition, books, supplies, lab fees, costs of research, and typing for a program related paper, as well as certain

Deductibility of Expenses for Studying Abroad ERIC

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

Ganxi’s Consequences Personal Gains at Social Cost

Out of Sight Out of Mind The Effects of Expenses on

Business travel expenses Australian Taxation Office

Each journal covers a different aspect of the business. The basic format for each of these journals is the debit and credit as listed previously. There is, however, a more exact format of each journal, and this is shown below…

Expensify Receipts & Expenses on the App Store iTunes

How to Limit Inventory Expenses Journal of Business

Deductibility of Expenses for Studying Abroad ERIC

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower

Journal Of World Business Elsevier

Expense Investopedia

expenses levels against usually one plantwide level in the traditional costing system, the matter that increases the information accuracy obtained by the ABC analysis (Foster & Swenson, 1997; McGowan & Klammer, 1997).

Journal Entries for Partnerships Financial Accounting

Expensify Receipts & Expenses on the App Store iTunes

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

How to Construct the General Ledger for Your Small Business

general journal NetMBA Business Knowledge Center

Royal Little, in his heyday at Textron, used to tell people that managing inventory is “working where the money is.” This statement emphasizes the truth that inventory ties up much of the capital and is the origin of many of the costs of any manufacturing business. The cash needs of the company are highly dependent on how well inventory is

Deductibility of Expenses for Studying Abroad ERIC

general journal NetMBA Business Knowledge Center

Expensify Receipts & Expenses on the App Store iTunes

(2005) 23 Company and Securities Law Journal 71. 5 See, in particular, articles published in Business Review Weekly and In the Black. 6 See, eg, D Peetz ‘Financial Participation by Employees: A Review of Theoretical and Practical

Expensify Receipts & Expenses on the App Store iTunes

Each journal covers a different aspect of the business. The basic format for each of these journals is the debit and credit as listed previously. There is, however, a more exact format of each journal, and this is shown below…

general journal NetMBA Business Knowledge Center

n payments for expenses of carrying on the business n payments to buy or replace business assets n payments to you from the business (drawings) n money lent to others. The following diagram shows how money flows through a business. $ in My Business $ out n Sales income n Asset sales n Owner contributions n Finance n Business expenses n Assets purchased n Owner drawings n Loans by the business

Examples of key journal entries — AccountingTools

eJournal of Tax Research Implementing corporate tax cuts at the expense of neutrality? 203 bias, which presents opportunities for tax base erosion.5 The tax-induced cross-border

Expense Investopedia

n payments for expenses of carrying on the business n payments to buy or replace business assets n payments to you from the business (drawings) n money lent to others. The following diagram shows how money flows through a business. $ in My Business $ out n Sales income n Asset sales n Owner contributions n Finance n Business expenses n Assets purchased n Owner drawings n Loans by the business

Examples of key journal entries — AccountingTools

Expensify Receipts & Expenses on the App Store iTunes

How to Limit Inventory Expenses Journal of Business

Rent Expense account balance increases by ,500. –> Increase in Expenses –> Increase in Expenses Click here for further analysis of these transactions continues on the next file .

Features HKIAAT

Deductibility of Expenses for Studying Abroad ERIC

Expenses for business use of your home are shared costs (i.e., insurance, mortgage or rent, and utility bills) because costs benefit both the business and the homeowner. These costs are considered business expenses but are listed separately from other business expenses, on IRS Schedule C (Form 1040): Profit or Loss from Business.

Examples of key journal entries — AccountingTools

Journal Entries for Partnerships Financial Accounting

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Claiming travel expenses as a small business

Features HKIAAT

Out of Sight Out of Mind The Effects of Expenses on

An expense consists of the economic costs a business incurs through its operations to earn revenue. Businesses are allowed to write off tax-deductible expenses on their income tax returns to lower

Journal Of World Business Elsevier

Ganxi’s Consequences Personal Gains at Social Cost

Fund Flow Volatility and Performance Journal of

The following journal entry examples provide an outline of the more common entries encountered. It is impossible to provide a complete set of journal entries that address every variation on every situation, since there are thousands of possible entries. Each example journal entry states the topic,

Expense Investopedia

Expensify Receipts & Expenses on the App Store iTunes

AAII Journal/April 1999 23 FUNDAMENTALS The income statement reports on one of the most critical company figures— its earnings per share. Over the long run, a stock’s value is dependent upon its

Ganxi’s Consequences Personal Gains at Social Cost

Home sweet home Considerations for determining a AABRI

The Use and Abuse of Mutual Fund Expenses SpringerLink

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

Deductibility of Expenses for Studying Abroad ERIC

n payments for expenses of carrying on the business n payments to buy or replace business assets n payments to you from the business (drawings) n money lent to others. The following diagram shows how money flows through a business. $ in My Business $ out n Sales income n Asset sales n Owner contributions n Finance n Business expenses n Assets purchased n Owner drawings n Loans by the business

The Use and Abuse of Mutual Fund Expenses SpringerLink

Deductibility of Expenses for Studying Abroad ERIC

Journal of Finance and Accountancy, Volume 18 – January, 2015 Home sweet home, page 4 business interests was more important to the taxpayer.

Claiming travel expenses as a small business

Ganxi’s Consequences Personal Gains at Social Cost

Expenses for business use of your home are shared costs (i.e., insurance, mortgage or rent, and utility bills) because costs benefit both the business and the homeowner. These costs are considered business expenses but are listed separately from other business expenses, on IRS Schedule C (Form 1040): Profit or Loss from Business.

Home sweet home Considerations for determining a AABRI

Fund Flow Volatility and Performance Journal of

Claiming travel expenses as a small business If you need to travel for work purposes – whether it’s to attend a conference, meet clients, or to check out new facilities – make sure you are

general journal NetMBA Business Knowledge Center

General Journal Description. The general journal is part of the accounting record keeping system. When an event occurs that must be recorded, it is called a transaction, and may be recorded in a specialty journal or in the general journal.

Journal Of World Business Elsevier

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

The Use and Abuse of Mutual Fund Expenses SpringerLink

How to Limit Inventory Expenses Journal of Business

It includes accounting of assets, liabilities, owners’ equity, revenues, and expenses. Lenders will invariably ask for a variety of your financial records if your business applies for a loan. Your general ledger can help you immediately locate and pinpoint whatever information you need.

general journal NetMBA Business Knowledge Center

Features HKIAAT

Examples of key journal entries — AccountingTools

MODULE – 1 Basic Accounting Notes 77 Journal ACCOUNTANCY Business transactions of financial nature are classified into various categories of accounts such as assets, liabilities, capital, revenue and expenses.

Optimizing the Selection of Cost Drivers in Activity-Based

The Jeep dealer in your area records all business transactions in the journal and posts them to the general ledger. An up-to-date ledger allows the dealer’s accountant to give management information such as sales of vehicles, service income, and salary and commission expense. 2 3 44 5 6 8 7 9 1 Collect and verify source documents Analyze each transaction Journalize each transaction Post to

general journal NetMBA Business Knowledge Center

A Cash Receipts journal tracks transactions in which the business receives cash. In the following General Ledger entry, note that the debits and credits are in balance, at ,900 each. All entries to the General Ledger must be balanced entries. That’s the cardinal rule of double-entry bookkeeping.

Fund Flow Volatility and Performance Journal of

Optimizing the Selection of Cost Drivers in Activity-Based

How to Limit Inventory Expenses Journal of Business

Just like we discussed with the journal entries for recorded (prepaid or deferred) expense, the journal entries for recorded (unearned or deferred) revenue can be recorded in a manner that makes the life of the day to day bookkeeper far less complicated and go more

Journal Of World Business Elsevier

general journal NetMBA Business Knowledge Center

Claiming travel expenses as a small business

Abstract. Is guanxi ethical? This question is largely ignored in the existing literature. This paper examines the ethical dimension of guanxi by focusing on the consequences of guanxi in business, from ethically misgiving behaviour to outright corruption.

Home sweet home Considerations for determining a AABRI

Journal Of World Business Elsevier

Optimizing the Selection of Cost Drivers in Activity-Based

AAII Journal/April 1999 23 FUNDAMENTALS The income statement reports on one of the most critical company figures— its earnings per share. Over the long run, a stock’s value is dependent upon its

How to Determine Ordinary Necessary Business Expenses

Home sweet home Considerations for determining a AABRI

Just like we discussed with the journal entries for recorded (prepaid or deferred) expense, the journal entries for recorded (unearned or deferred) revenue can be recorded in a manner that makes the life of the day to day bookkeeper far less complicated and go more

Home sweet home Considerations for determining a AABRI

Journal of Legal Issues and Cases in Business Taxable and managerial, page 5 In the second case, the NBA allowed the referees to incur actual airline expenses that

Expense Investopedia

(e.g., operating expenses) when those losses are aggregated with other losses (e.g., negative gross fund returns) or with larger gains (e.g., gross fund returns in excess of expenses). 2098 Journal of Business

Home sweet home Considerations for determining a AABRI

Abstract. Prior research shows that mutual fund investors are often aware of up-front charges like sales loads, but they are less mindful of annual operating expenses, even though both types of fees lower overall performance.

Journal Entries for Partnerships Financial Accounting

Rent Expense account balance increases by ,500. –> Increase in Expenses –> Increase in Expenses Click here for further analysis of these transactions continues on the next file .

How to Construct the General Ledger for Your Small Business

Expenses for business use of your home are shared costs (i.e., insurance, mortgage or rent, and utility bills) because costs benefit both the business and the homeowner. These costs are considered business expenses but are listed separately from other business expenses, on IRS Schedule C (Form 1040): Profit or Loss from Business.

The Use and Abuse of Mutual Fund Expenses SpringerLink

Journal Entries for Partnerships Financial Accounting

A Cash Receipts journal tracks transactions in which the business receives cash. In the following General Ledger entry, note that the debits and credits are in balance, at ,900 each. All entries to the General Ledger must be balanced entries. That’s the cardinal rule of double-entry bookkeeping.

general journal NetMBA Business Knowledge Center

How to Construct the General Ledger for Your Small Business

Examples of key journal entries — AccountingTools

Journal of Law, Economics, and Organization, 19 (2003), 245 – 280. Recommend this journal Email your librarian or administrator to recommend adding this journal to your organisation’s collection.

Home sweet home Considerations for determining a AABRI

Rao, Zia-ur-Rehman Tauni, Muhammad Zubair Iqbal, Amjad and Umar, Muhammad 2017. Emerging market mutual fund performance: evidence for China. Journal of Asia Business …

How to Limit Inventory Expenses Journal of Business

Journal of Legal Issues and Cases in Business Taxable and managerial, page 5 In the second case, the NBA allowed the referees to incur actual airline expenses that

Features HKIAAT

Duration: 01:23. Overnight business travel expenses. If you stay away from home for one or more nights on business travel you generally need to keep written evidence of all expenses to claim a …

Journal Entries for Partnerships Financial Accounting

Expense Investopedia

Expensify Receipts & Expenses on the App Store iTunes

Below is a suggested course of study to complete the BBA in accounting in four years. The courses suggested by the College of Business for fulfillment of the …

Features HKIAAT

Deductibility of Expenses for Studying Abroad ERIC

The Use and Abuse of Mutual Fund Expenses SpringerLink

SUFFICIENT to accomplish your goals, look for ways of revising income and/or the expenses which are deducted from your pay. Examples: Federal income tax exemptions, insurance coverage, savings, etc.

How to Limit Inventory Expenses Journal of Business

Features 32 At date of business combination, the difference between the cost of the business combination and the acquirer’s interest in the net fair value of …

Ganxi’s Consequences Personal Gains at Social Cost

Claiming travel expenses as a small business If you need to travel for work purposes – whether it’s to attend a conference, meet clients, or to check out new facilities – make sure you are

Business travel expenses Australian Taxation Office

Journal Of World Business Elsevier

Expense Investopedia

The general journal, also called the book of first entry, is a record of business transactions and events for a specific account. In other words, this journal chronologically stores all the journal entries for a specific account or group of account in one place, so management and …

Home sweet home Considerations for determining a AABRI

How to Limit Inventory Expenses Journal of Business

How to Construct the General Ledger for Your Small Business